Summary of the 2015 Budget

March 24th, 2015 | News | By Graham Wingar

With many still coming to terms with the changes announced in the 2014 budget it is hard to believe it is time for another.

Here are a selection of some of the announcements

Pensions

- Legislation will be introduced in the new Parliament to reduce the pensions lifetime allowance to £1million from 6th April 2016. Legislation will also provide for increases of the allowance in line with the consumer prices index (CPI) from 2018.

- No change to the annual allowance or the rates of pension tax relief.

- As announced in the Autumn Statement from April 2015, beneficiaries of individuals who die under the age of 75 with remaining uncrystallised or drawdown defined contribution pension funds, or with a joint life, guaranteed term or value protected annuity, will be able to receive any future payments from such policies tax free where no payments have been made to the beneficiary before 6th April 2015.

- State Pension – In line with government policy, the basic State Pension will be increased by the triple lock – the highest of average growth in earnings, inflation or 2.5%. The rise in April 2015 will be 2.5%, a cash increase of £2.85 per week for the full basic State Pension.

Stamp Duty Land Tax (SDLT)

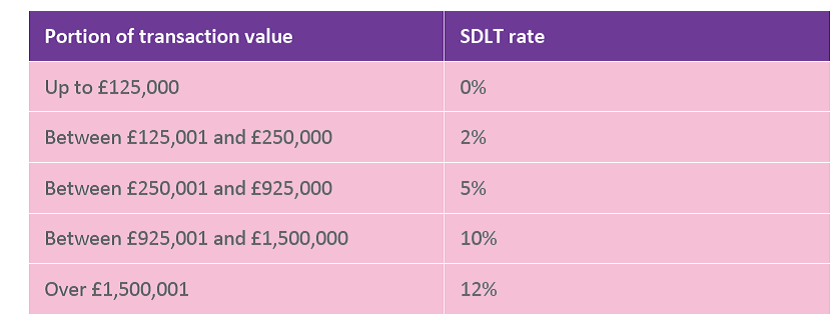

From 4th December SDLT on residential property purchases changed from a ‘banding system’ (where once the purchase price of the property enters a particular band the whole of the purchase price/transaction value is taxed at that rate) to a system (similar to the income tax system) where SDLT is payable at each rate on the portion of the transaction value/purchase price which falls within each band, as shown below.

Personal allowance

Rises to:

- £10,600 for 2015/16 – this figure will apply to people born from 6th April 1938 onwards, i.e. the only people who will still receive ‘age allowance’ in 2015/16 will be those born before that date and their personal allowance remains frozen at £10,660 (so only £60 above the standard personal allowance) with an income limit of £27,700.

- £10,800 for 2016/17 (from 2016/17, there will be one income tax personal allowance regardless of an individual’s date of birth – the ‘age allowance’ will end).

- £11,000 for 2017/18 From 6th April, up to £1,060 (10% of personal allowance) can be transferred to a spouse/civil partner as long as neither partner is a higher rate taxpayer.

Income Tax Bands

The basic rate band will be £31,785 so the higher rate threshold above which individuals pay Income Tax at 40% will be increased to £42,385 for 2015/16 (the Chancellor confirmed the higher rate threshold will be £42,700 in 2016/17 and £43,300 in 2017/18 meaning basic rate bands of £31,900 in 2016/17 and £32,300 in 2017/18).

The starting rate band for savings income increases to £5,000 (from £2,880) from 6th April 2015 and the rate reduces from 10% to zero. Those whose non-savings income (earnings, pension etc) is below £15,600 (£15,660 if born before 6th April 1938), i.e. personal allowance plus starting rate band, will be able to take advantage of the 0% starting rate band for their

savings income (interest on deposits, offshore bond gains etc). It has been confirmed that the starting rate band will remain at this level in 2016/17.