Coronavirus and the Financial Markets

March 17th, 2020 | News | By Graham Wingar

With COVID-19 taking centre stage in the headlines and with much of the publicity being around the economic effects, I wanted to keep our valued clients in the loop with our considerations of the current circumstances.

I won’t speculate on the timelines for the virus itself to come under control, I will leave that to the healthcare experts.

For new investors who have not seen large market movements, then the current market behaviour and consequently, their portfolio performance, can be quite a stressful time. For those who have invested through the likes of the 2001 dot com bubble and the 2008 banking crisis, hopefully they have been given enough experience to understand the benefits of going through these market conditions.

This stress can cause investors to second guess their investment strategy and some investors may be asking themselves, “do I leave or hold on?” This can be viewed as rational or irrational.

If the statement means you are considering whether markets are higher now or at some other point in the near future, this is a potentially dangerous stance. We have heard people say, “I think markets will continue to fall because the virus-effect on business will only get worse”; it’s true there is likely to be greater disruption in the coming months but this information is commonly known and therefore has been taken into account and is the reason markets have moved so quickly in recent weeks. What we don’t know is if the disruption, and therefore economic impact, will be greater than expected by investors (and consequently cause further drops), or if further developments mean that the expected disruption reduces. One thing I can say for certain is……. I have no idea which it is! I would also dispute any person who says they do know. Many people believe they know because there are two outcomes and one of them has to play out, so many people with strong opinions will be “right”. If the call is right and timed right, it could be a large financial gain but it could also go the other way. Any significant moving in or out of markets significantly increases the overall risk and potential loss. The other known ‘unknown’ is exactly how long it will take for some level of certainty around the disruption to come through.

Another way to look at the statement “do I leave or hold on?” is in some cases this could be a client reconsidering whether or not they want to be an investor. This is a decision between taking no investment risk and accepting the returns that cash have to offer (the Bank of England interest rate cut today will likely cause even lower deposit rates), or accept the markets will do what they do. This could be deemed rational as, if a client is not willing to take the volatility of investments, it is unlikely to be suitable; what we have to consider is if this stance is a reaction or a genuine view. All clients would have discussed the potential bad periods of performance and what has happened in the past, but we also acknowledge there is a difference between a hypothetical discussion and real market movements.

What is it Markets do?

Basically, they don’t move in a straight line. This is why investors get a greater long term return than cash. It is the premium they receive for the shorter term uncertainty of the higher risk investment assets. With this in mind, general increases in consumerism and government policy targeting a level of inflation, there is little expectation that markets won’t continue with their long term returns.

In the short term the markets will continue to be volatile as more information comes to light on the potential timeline for the virus to come under control, the likely disruption to businesses and the government’s intended interventions. Which direction the markets will move in the short term cannot be predicted with any degree of certainty (again making a prediction and it being right doesn’t mean it was known). What we can do however, is look at how markets recover from economic downturns.

In the 2008 banking crisis, the economy was affected by the continued knock-on effect of a slowdown in economic output and reduced earnings and job losses. Although completely different scenarios, it is business disruption that could cause a slowdown in economic output which is causing the market declines currently. As the virus spreads it is expected that people will be spending less and therefore, potentially earning less and on it goes.

It is by no means a prediction that markets during the virus outbreak will act the same as in 2008, however, it is an example of how markets have recovered after a period of poor economic conditions.

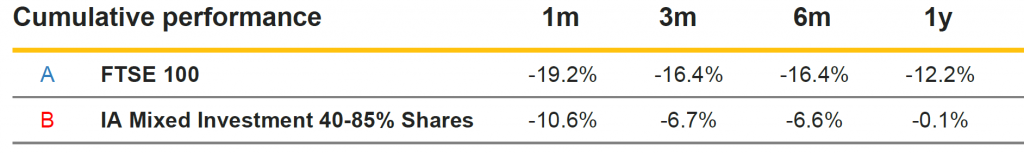

To help visualise this, the graphs below show the benefits of a diverse investment and I have included data of the IA Mixed Investment 40-85% shares sector (the average performance of the funds in the sector with an equity content of 40-85%), alongside the performance of the FTSE100 (the capital value of the 100 largest companies in the UK).

Pic 1: The first graph shows the two over the last 12 months [courtesy of FE Fund info]

The graph and figures show a very significant drop in the last month, this indicates the progressive nature of the developments and implications surrounding the virus with the FTSE100 being down around 20%. This speed and depth of drop is broadly similar to that experienced around October 2008.

The graph and figures show a very significant drop in the last month, this indicates the progressive nature of the developments and implications surrounding the virus with the FTSE100 being down around 20%. This speed and depth of drop is broadly similar to that experienced around October 2008.

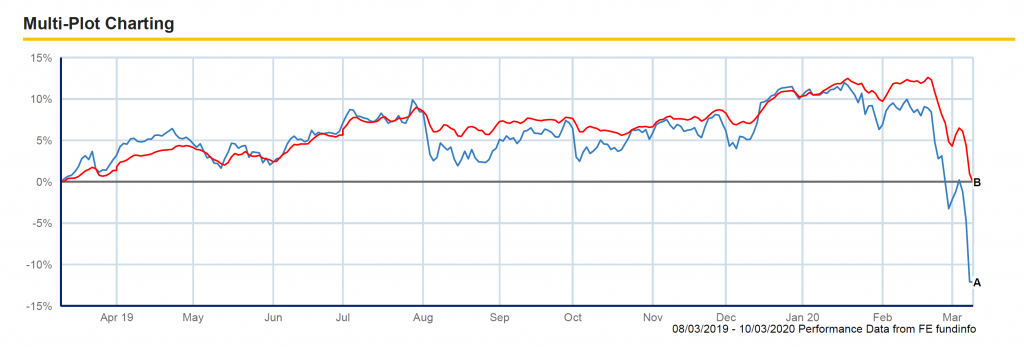

Pic 2: The second graph shows the same two markets over 2008 and 2009

You can also see that the FTSE100, at its worst point in 2009, was down around 40% from previous highs in 2008. This should by no means be taken as an indication of how the market will play out over the coming months, but what it does show us is that market drops occur and that they do subsequently recover.

My last thoughts…..

Having a long enough timeline means that you can be confident that the markets will recover and reward you for taking the volatility and uncertainty as an investor. It also can be a dangerous place for people who try and second guess a movement direction at any particular time. By sticking too long-tested investment principles of focusing on time in the markets rather than timing the markets, we greatly increase the chances of positive outcomes over the long term. If we do not stick to a long term approach we are reliant on timing creating a gain or a loss. This isn’t something I would recommend to any of our clients.